Savings and mindful spending are here to stay

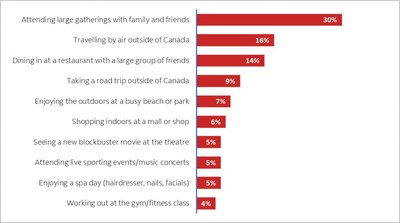

TORONTO, May 5, 2021 /CNW/ - While Canadians continue living through some forms of restrictions due to COVID-19, many are looking ahead to life after the pandemic. According to a recent Scotiabank survey, the top three things Canadians are looking forward to the most after the pandemic include attending large gatherings with family and friends, travelling by air outside of Canada and enjoying a meal at a restaurant with friends.

While Canadians are looking forward to doing the things they haven't been able to do in a long time, when it comes to their finances, they're not planning on returning to their pre-pandemic spending patterns. Many Canadians developed positive money habits over the course of the pandemic, with reduced spending in key areas and increased savings - and they plan to continue these habits after the pandemic. More than a third (36%) of Canadians plan to continue eliminating unnecessary or discretionary spending, 34% plan to continue doing more research before making purchases, more than a quarter (28%) plan to keep building up their emergency savings, and 28% plan to continue with a monthly budget.

"We're seeing a record number of deposits in Canadians' bank accounts which presents a huge opportunity, especially for the sectors hit hardest by the pandemic, like travel and hospitality," said D'Arcy McDonald, SVP, Deposits, Investments, & Payments at Scotiabank. "The Scotiabank survey highlights Canadians' eagerness to spend on what they've missed out on for more than a year – travel, restaurant dining, attending social events - but we're encouraged that so many plan on carrying the strong money habits they've developed in the future."

Almost half of Canadians (46%) say they have been able to save more money during the pandemic than in a typical year and 47% think they will still be able to maintain the same level of saving after life returns to a more normal state after the pandemic. Twenty-five percent don't think they'll be able to manage the same level of saving.

"As Canadians wait for the country to re-open, now is the time to review their finances to ensure they can maintain good financial health after the pandemic," added McDonald. "Review your budget, save where you can, and where you do need to spend, continue leveraging your debit and credit cards to earn points that you can put towards your future travel or entertainment plans."

Activities Canadians are looking forward to the most, after the pandemic

Scotiabank Pro Tips

- Choose the right bank account for your lifestyle. When it comes to banking, Canadians rate online bill payment options, low or no fees for everyday banking, and free online and mobile banking as the most valuable features during the pandemic. Review your current bank account and ask yourself some important questions. Are you overpaying in fees? Does your account offer unlimited debit transactions, no-fee international money transfers and an annual fee credit card waiver? Are you taking advantage of all the benefits and features? If not, ensure you get a bank account that delivers on everything you need for your current lifestyle. The Ultimate Package from Scotiabank for example offers all of these benefits as well as additional perks.*

- Put your savings to work. The pandemic has taught us the importance of having an emergency fund. More than a quarter of Canadians plan to keep building up their emergency savings post-pandemic, but make sure those savings are earning more money in a high-interest savings account with a competitive interest rate. With Scotiabank's MomentumPLUS Savings Account, account holders earn regular interest, premium period interest, and Ultimate Package account holders earn an additional annual interest.

- Earn while you spend. More than half of Canadians (54%) are using their credit cards for payment most frequently during the pandemic, followed by their debit cards (31%). The next time you reach for your wallet, ensure you choose the right debit or credit card that earns you the most rewards on your purchases. ScotiaRewards® is one of the most flexible rewards and loyalty programs in Canada, anchored by the largest entertainment loyalty program in the country, SCENE. Scotiabank customers can earn ScotiaRewards using their credit or debit cards. When you're ready for travel, you can use your ScotiaRewards points to book flights, hotels, cruises, car rentals, tours and more. You can also choose to book a trip with any travel provider and use your points towards your trip costs.

- Get the right financial advice. To help Canadians with their financial needs, Scotiabank designed the Scotia Advice+ Centre, an online hub that provides financial resources including a comprehensive self-help approach to financial planning, with the option to book an in-person appointment with a Scotia advisor for more personalized, tailored advice.

Methodology: From April 16 to April 18, 2021, an online survey of 1,517 randomly selected Canadian adults who are Maru Voice Canada panelists was conducted on behalf of Scotiabank by Maru/Blue. The results of this study have been weighted by education, age, gender and region (and in Quebec, language) to match the population, according to Census data. This is to ensure the sample is representative of the entire adult population of Canada. Discrepancies in or between totals are due to rounding.

About Scotiabank

Scotiabank is a leading bank in the Americas. Guided by our purpose: "for every future", we help our customers, their families and their communities achieve success through a broad range of advice, products and services, including personal and commercial banking, wealth management and private banking, corporate and investment banking, and capital markets. With a team of approximately 90,000 employees and assets of approximately $1.2 trillion (as at January 31, 2021), Scotiabank trades on the Toronto Stock Exchange (TSX: BNS) and New York Stock Exchange (NYSE: BNS). For more information, please visit http://www.scotiabank.com and follow us on Twitter @ScotiabankViews.

*Conditions apply. Visit www.scotiabank.com/ultimate300

SOURCE Scotiabank