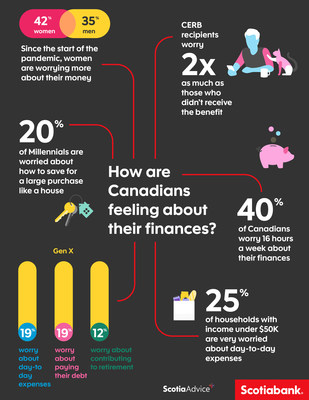

Nearly 40% of Canadians are worrying 16 hours a week about their finances, Scotiabank poll

- Millennials age 18-34 (45%) are worrying more about their finances than pre-pandemic

- Women (42%) are worrying more than men (35%) about their finances since the start of the pandemic

- Canadians who received the Canada Emergency Response Benefit (CERB) worry twice as much about their finances than those who did not receive the benefit

TORONTO, Dec. 15, 2020 /CNW/ - Nearly 40% of Canadians are worrying more about their finances since COVID-19 began, spending an average of 16 hours a week worrying. Meanwhile, 28% of Canadians say that they do not spend any time worrying about their finances.

Millennials age 18-34 (45%) are worrying more about their financial health since the start of the COVID-19 pandemic. Women (42%) reported worrying more than men (35%) about their finances since the start of the pandemic, reinforcing Scotiabank Economics' commentary on the impact the recession has had on women.

"The pandemic has had a disproportionate financial impact on women and millennials, who were faced with job loss, reduced hours or having to leave work to devote more time to childcare," said D'Arcy McDonald, SVP, Deposits, Investments, & Payments at Scotiabank. "At Scotiabank, we're focused on providing our customers with the advice and support they need to navigate this uncertain time and are confident that even a simple conversation with an advisor can have a meaningful difference on our customers' peace of mind."

Generational Divide:

45% of millennials are worrying more about their finances now than before pandemic, a stark contrast to the 64% of Canadians age 55+ who said they are worrying less about their finances.

Canadians ages 55+ have been the least financially impacted by the pandemic. Nearly six-in-10 (58%) say they have not been impacted.

Canadians aged 55+ are the most likely to have worked with a financial advisor before the pandemic (39%), compared with 28% of 18-34-year-olds.

Relief Funds

Younger Canadians are most likely to have received the Canada Emergency Response Benefit (CERB). Nearly one in four Canadians between the ages of 18 and 34 have received this financial benefit (24%) compared with 18% between the ages of 35-54 years and 9% of those aged 55+.

Almost two-thirds of Canadians who received CERB are concerned about the expiry of government relief programs and their ability to meet household expenses without them (64%).

Two thirds of Canadians who have received CERB are concerned about the effect this will have on their tax return (67%). Concern levels are higher among Canadians 18-34-year-old (72%) compared with just 49% of those ages 55+.

Scotiabank's Top Tips to Manage Financial Worry

- Get financial advice. Having financial peace of mind can help alleviate stress and provide confidence that you have a plan to face whatever challenges lay ahead. An advisor can help build a financial plan that's tailored to you and that considers your financial goals today and tomorrow.

- Set a budget. Start by looking at your current expenses honestly and adjust accordingly. This will help you plan for your expenses, while allowing you to more easily set aside money for an emergency. If you received CERB, remember that the benefit is considered taxable income and Canadians may have to pay taxes on that income in the 2021 tax season.

- Stack your emergency fund. The common rule is to save 3-6 months of salary but ask yourself if that's the right amount and are your savings working for you. If you're self-employed or a single income household, you may consider saving more. Contributing whatever you can to your fund, even $20 a month, will make a big difference over time. Setting up automatic deposits to your emergency fund will allow you to save without having to worry about it. And better yet, consider putting your savings into accounts that earn you interest and can be redeemed without penalty. It's always a good idea to check if your employer offers programs that help match your savings as well.

Scotiabank Can Help

For customers concerned about navigating their financial plans, Scotiabank recently launched Advice+, a new service that offers customers a range of options to seek financial advice during these challenging times. Advice+ offers a new online hub called the ScotiaAdvice Centre, which provides a comprehensive self-help approach to financial planning and the option to book an in-person appointment with a Scotiabank financial advisor for more personalized, tailored advice.

Methodology: The 2020 Scotiabank Financial Worry poll was conducted on behalf of Scotiabank by Maru Blue from November 20 – 22, 2020. The online survey captured the opinions of 1,510 Canadians across the country and results of this study are weighted by education, age, gender and region (and in Quebec, language) to match the population, according to 2016 Census data.

About Scotiabank

Scotiabank is a leading bank in the Americas. Guided by our purpose: "for every future", we help our customers, their families and their communities achieve success through a broad range of advice, products and services, including personal and commercial banking, wealth management and private banking, corporate and investment banking, and capital markets. With a team of over 90,000 employees and assets of approximately $1.1 trillion (as at October 31, 2020), Scotiabank trades on the Toronto Stock Exchange (TSX: BNS) and New York Stock Exchange (NYSE: BNS). For more information, please visit http://www.scotiabank.com and follow us on Twitter @ScotiabankViews.

SOURCE Scotiabank